GenAI-Empowered Pre-Screen Document Generation

The Challenge of Financial Pre-Screening

Financial institutions handle immense volumes of complex documents that require thorough analysis before making credit, investment, or compliance decisions. Traditional pre-screening approaches face three critical challenges:

Manual Processing Bottlenecks

Analysts spend hours manually reviewing and writing documents, causing decision delays and reducing productivity.

Inconsistent Analysis

Human-only review introduces variability in how financial data is interpreted and assessed.

Costly Third-Party Analysis Tools

Reliance on third party platforms (e.g. Credit Lens) creates budget constraints.

These challenges significantly impact efficiency, with pre-screening processes often taking days or weeks rather than hours, creating bottlenecks that affect the entire financial decision pipeline.

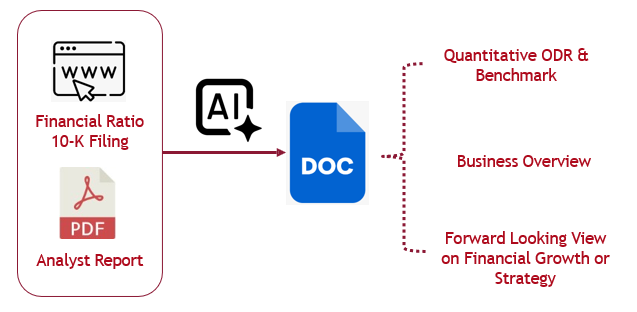

Transforming Pre-Screening with GenAI

The level of complexity in financial documents pushed the boundaries of traditional document processing. Our GenAI solution works with financial institutions to implement intelligent document generation that satisfies their specific needs. We focus on three main areas:

Key Components of GenAI Pre-Screening

- Part 1: AIRB Model Determination & Quantitative ODR Calibration - Automatically extracts and analyzes financial ratios, calculates risk metrics, and benchmarks against industry standards.

- Part 2: Business Overview & Company Description - Intelligently summarizes company information, market position, and operational factors to provide context beyond numbers.

- Part 3: Forward Looking View on Financial Growth - Generates projections and insights based on historical data and market trends to support decision-making.

Human-in-the-loop Collaboration

A key differentiator of our GenAI pre-screening solution is its emphasis on human-in-the-loop workflows. The platform is designed as a tool where AI can collaborate effectively with financial analysts, who can review, edit, and approve calculated spreading and document sections as needed.

Conclusion

By reducing the effort of creating and analyzing financial documents, the GenAI pre-screening solution has significant improved the process of risk assessment and decision-making:

"The GenAI pre-screening solution has transformed our loan approval process. What used to take our analysts days now happens in hours, with greater accuracy and consistency. We've seen a dramatic improvement in our ability to identify risks early while accelerating decision-making."